In 2020, China’s famous Sina.com revealed a Global Male Smoking Prevalence Ranking, in which Malaysia ranked sixth with a significant figure of male smoking prevalence, while Indonesia topped the list with a high male smoking prevalence rate of 76%, followed by Russia with 58% male smoking prevalence rate. Egypt follows in third place with a smoking prevalence of 50%. Side by side, this reflects the dire smoking situation in Malaysia.

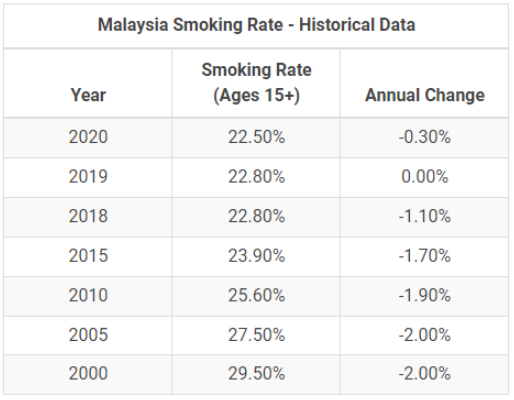

Changes in Smoking Prevalence in Malaysia (2000-2020)

Chart data source: macrotrends

The existence of thousands of traditional smokers has created a huge growth potential for the e-cigarette market. Therefore, in recent years, more and more Chinese brand companies have started to set their sights on Southeast Asia and have traveled to the region to seek for business. SMOANT has also established an overseas factory in Malaysia and opened several e-cigarette stores.

According to the recently released Malaysia Electronic Cigarette Chamber of Commerce (MVCC) report “Malaysia Electronic Cigarette Industry Study 2023”, the popularity of e-cigarettes in Malaysia is growingg rapidly.

Data shows that as many as 31% of Malaysian traditional smokers have completely switched to e-cigarettes. This shift not only indicates the wide acceptance of e-cigarettes in the Malaysian market, but also reflects the local public’s awareness of healthy lifestyles. At the same time, 69% of cigarette users choose to use e-cigarettes, which undoubtedly proves the strong competitiveness of e-cigarettes in the Malaysian tobacco market.

In 2023, an amazing growth momentum in the international market has shown in China’s e-cigarette industry. According to statistics, the annual export of e-cigarette products totals up to 110.84 billion U.S. dollars, with an impressive increase of 12.50% year-on-year. In 2023, total China’s e-cigarette exports to the United States reached 3.101 billion U.S. dollars, accounting for 27.98% of the total export value.

The following countries are the UK, Germany, South Korea, and Russia, which are important export markets for China’s e-cigarette products. In addition, Malaysia, the Netherlands, Canada, Australia, and the Philippines are the top 10 e-cigarette exporting countries. With the vigorous development of the local market and open acceptance, Malaysia has jumped to become the sixth-largest export market for China’s e-cigarette products. In 2023, China’s total e-cigarette exports to Malaysia achieved a remarkable growth of 22.61%, which highlights the strong competitiveness of China’s e-cigarettes in the global market, and reflects the strong demand for e-cigarette products in the Malaysian market.

Why is the Malaysian market growing rapidly?

The geographical superiority, Malaysia is located in the heart of Southeast Asia, it is like a bridge that closely connects China and other major countries in Southeast Asia. The superior geographical location makes it exceptionally easy to travel to neighboring countries such as Indonesia, the Philippines, Thailand or Vietnam, whether by land, sea or air. This convenient transportation network greatly reduces logistics costs and saves logistics time, bringing great convenience to sales and transportation.

Second, the advantage is the security environment. Social security and stability and the comprehensive law system in Malaysia, create a safe environment for business activities.

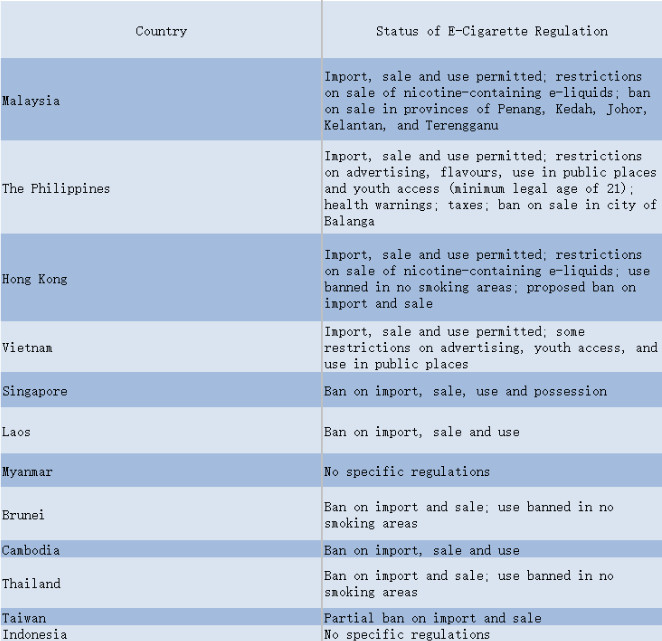

The last but not least advantage is that Malaysia has a relaxed policy attitude towards the e-cigarette industry. The government allows the import, sale, and use of e-cigarettes, and only restricts the sale of e-liquids containing nicotine in specific areas. Such a policy environment provides strong support for the healthy development of the e-cigarette market and flexible market development for investors and entrepreneurs.

With only 32 million Malaysia’s population, its e-cigarette market scope is the largest among Southeast Asian countries due to the high smoking rate, and a huge potential for Malaysia’s e-cigarette market, making it the ideal country for a favorable e-cigarette market.

Let’s take a brief look at the policy situation in other Southeast Asian countries (e-cigarette regulations in Southeast Asian countries/regions as of June 2020)

Edited by antbar